Types of Loans + Finance Tips

Related Resources + Files

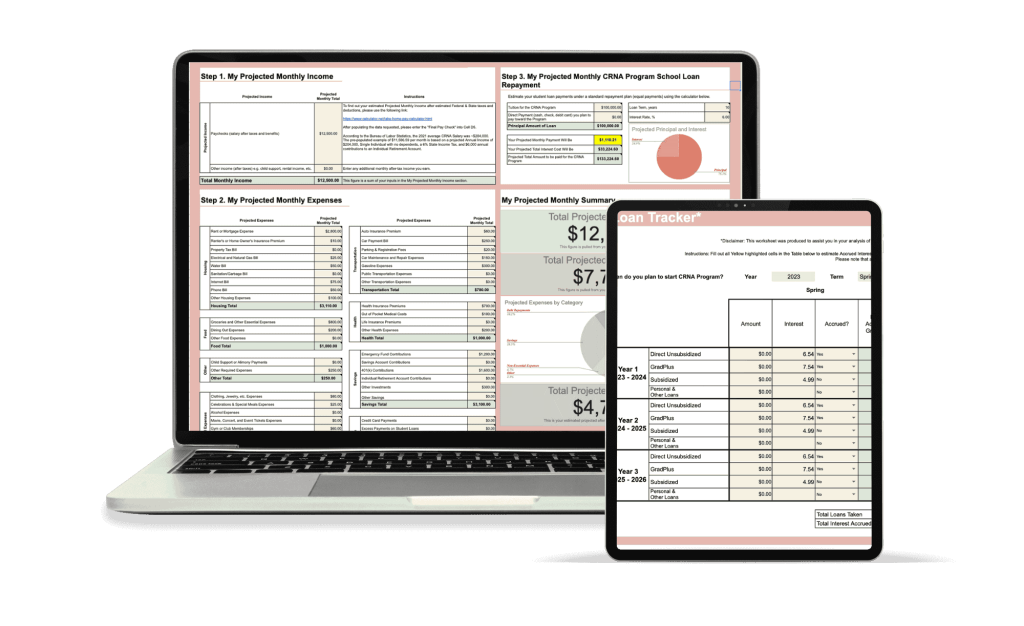

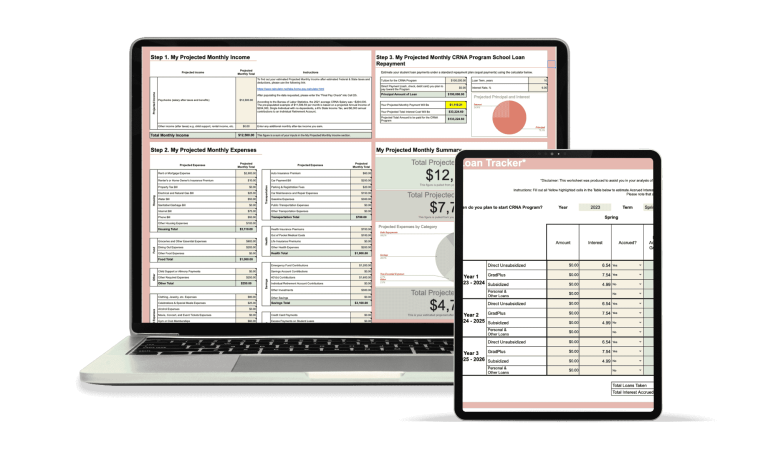

This is a PDF version of our School Comparison Cost Calculator (formally known as the Financial Planner). The goal of this tool is to show you what your life will look like after graduation (super roughly – we are not financial advisors) with different loan amounts – 100k loan vs. 200k loan for example.

There are many ways that people pay for CRNA schools, and the majority take out loans. Watch this lesson to grasp the basics on federal loans vs. private, and how to best set yourself up for success.

Some extra notes on finances

Paying for school

I can’t say this enough – you MUST do your research with a financial planner here. We don’t have all the answers and we definitely aren’t fit to provide official advice. What we CAN do is point you to some resources, and some things to consider.

First of all, the numbers we have in our School Database are ESTIMATES. We manually calculate these numbers, some include housing, some don’t, some include fees etc. And not to mention, some programs actually provide grants and those numbers can be even lower.

Some programs will cover cost of housing, others will not. So you may end up owing a LOT more than what’s listed on their site. Also, you need extra money for vacations, unexpected expenses (new car etc), or unexpected expenses that you don’t know about.

Most people will take out federal loans. You’ll get a disbursement a few days before each semester as a lump sum to hold you through the next semesters disbursement of funds. Other people have taken out private loans as well. A frequently asked question is – how much should I have saved? Well, as much as you can. Remember, some loans accrue interest as soon as you take the loan out. So that means, if you take out 50k your first semester, that accrues interest for THREE years. So, maybe a good option might be to pay a chunk up front if you can – check with your financial advisor depending on what loan type you take out. But remember, interest accruing is reaaaal.

Helpful links:

- Bureau of Labor Statistics – check out the most recent CRNA salary reportings

- StudentAid.Gov

- Types of Federal Loans (Unsubsidized vs. Grad PLUS)

- Grad PLUS Loan Information – you’ll find the most recent interest rates here, if you take out a federal loan, it’ll likely be a Grad PLUS loan along with a Direct Unsubsidized Loan

- Direct Unsubsidized Loan Information

(2024) Loan Types + Interest Rates

Loan Type | Interest Rate | Benefits |

Direct Unsubsidized Loan | 8.08% | Fixed-rate, federal protection |

Direct PLUS Loan | 9.08% | Fixed-rate, higher borrowing limit |

Private Loan (Variable) | 5.06% – 15.41% | Potentially lower rates, flexible terms |

Private Loan (Fixed) | 4.19% – 15.7% | Predictable payments based on credit |

Student Discounts to save you cash moneeeyyy:

- Amazon Textbook Rentals

- VitalSource – eTextbooks

- AnesthesiaHub

- EkoHealth Stethoscope Student Discount

- Apple Education Store

- Best Buy Student Deals

- Dell University

- Microsoft Education Store

- Lenovo Academic Purchase Program – up to 20% off laptops and tablets

- HP Student Store – special pricing on laptops, desktops, and printers

- Microsoft 365 Education – Word, Excel, Powerpoint

- Adobe Creative Cloud for Students (If you’re a student, recommend Adobe for resume editing!)

- SPSS Statistics for Students

- Grammarly Premium for students

- Amazon Prime Student

- Instacart Express (student discount)

- StudentUniverse – Discounts on flights, hotels, travel packages

- Airbnb – student discounts

- Amtrack – offers student discounts

- Expedia Student Deals

- UniDAYS – student-only shopping app that offers exclusive deals from a variety of brands

- Spotify Premium Student – 50% off Spotify Premium which includes Hulu and Showtime

- Cinemark – Student discounts available

A HUGE thank you to Javier, SRNA for putting this list together! Check out his blog posts on financial preparedness below.

School comparison cost calculator (financial planning tool)

I know you think that you’ll be making BANK and paying off your loans is no big deal, the reality is, people still spend years paying off their loans. Some pay them off aggressively in a few years, others pay them off over 10 years. Everyones situation is unique. We are NOT financial advisors, and we highly encourage you to do your own research. This tool/spreadsheet is created to show you realistically what life might look like after graduation if you took out different loan amounts and paid them back over different time periods.

What would it look like if I went to a 100k program and paid my loans back over 5 years? 10 years? How much would I be having to pay and what would I be taking home (roughly)?

What if my program was 250K, and I wanted to pay this back over 8 years, how much would I have to pay each month vs. how much would I be making?

Ready to keep watching?

SOME QUICK READS YOU MIGHT LIKE...

Take a listen TO THESE RELATED PODCAST EPISODES: